Why the Radiopharmaceutical CDMO Market is a Smart Investment: USD 8.50 Bn by 2035

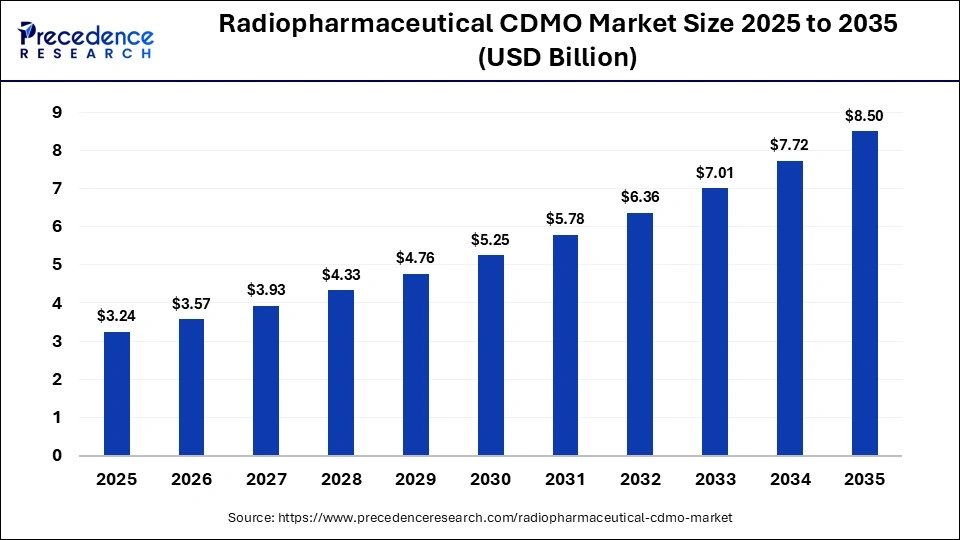

According to Precedence Research, the global radiopharmaceutical CDMO market size is predicted to surpass around USD 8.50 billion by 2035, increasing from USD 3.57 billion in 2026, expanding at a strong CAGR of 10.12% from 2026 to 2035.

Ottawa, Feb. 17, 2026 (GLOBE NEWSWIRE) -- The radiopharmaceutical CDMO market is driven by rising nuclear medicine use, growing outsourcing of radiopharmaceutical development, and demand for compliant, end-to-end manufacturing solutions.

The global radiopharmaceutical CDMO market size was estimated at USD 3.24 billion in 2025 and is expected to be worth USD 8.50 billion by 2035, growing at a significant CAGR of 10.12% from 2026 to 2035. The growing demand for the treatment of metastatic cancer and the outsourcing trends drive the radiopharmaceutical CDMO market growth.

The Complete Study is Now Available for Immediate Access | Download the Sample Pages of this Report@ https://www.precedenceresearch.com/sample/7320

Radiopharmaceutical CDMO Market Key Takeaways

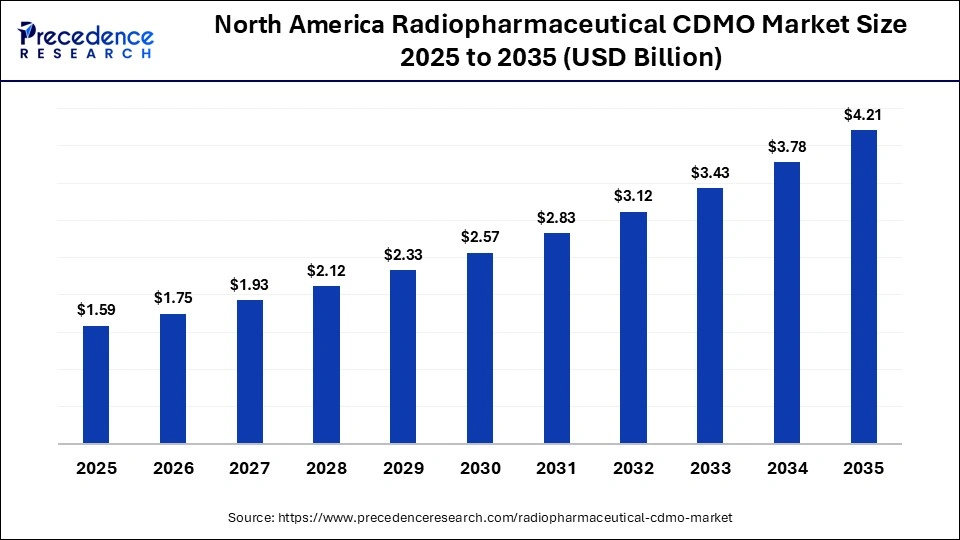

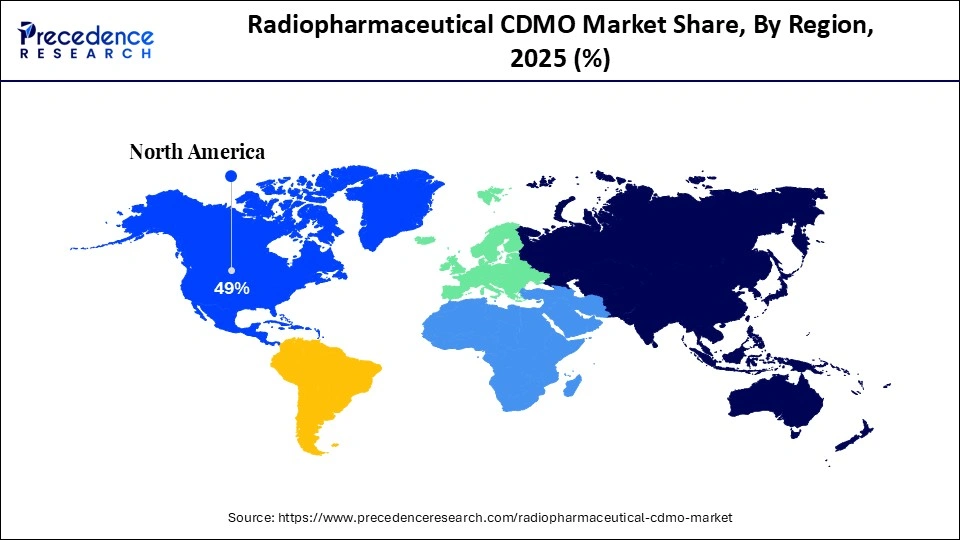

- Regional Leadership: North America led the global radiopharmaceutical CDMO market in 2025, accounting for approximately 49% of total revenue.

- Fastest-Growing Region: Asia-Pacific is projected to expand at the fastest CAGR between 2026 and 2035, driven by rising nuclear medicine investments and manufacturing capacity expansion.

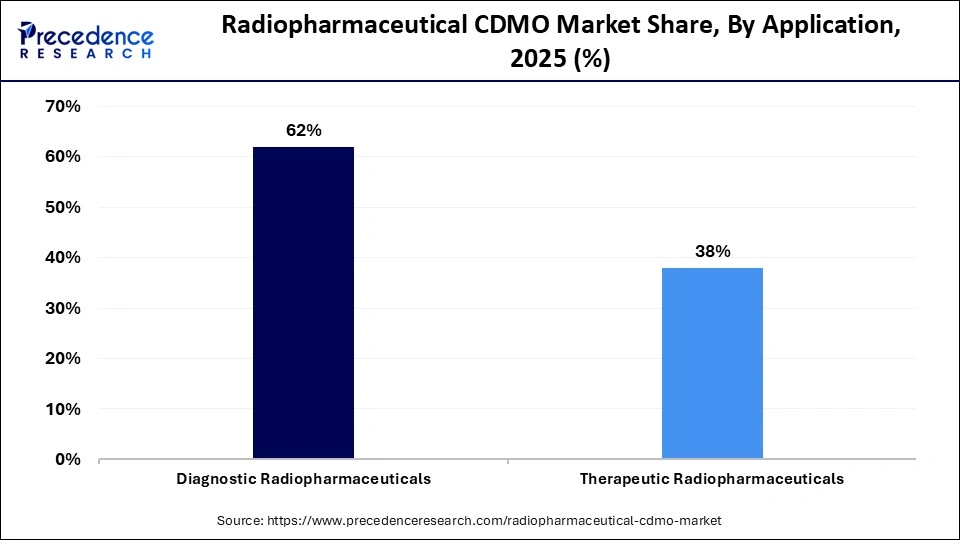

- Application Leadership: Diagnostic radiopharmaceuticals dominated the market with about 62% share in 2025, reflecting strong clinical demand for imaging applications.

- Fastest-Growing Application: Therapeutic radiopharmaceuticals are expected to grow at the highest CAGR from 2026 to 2035, supported by increasing adoption of targeted radionuclide therapies.

- Radioisotope Leadership: The Fluorine-18 segment held around 34% of the market share in 2025, due to its widespread use in PET imaging.

-

Fastest-Growing Radioisotope: Actinium-225 is projected to register strong CAGR growth between 2026 and 2035, driven by advancements in alpha-emitting cancer therapies.

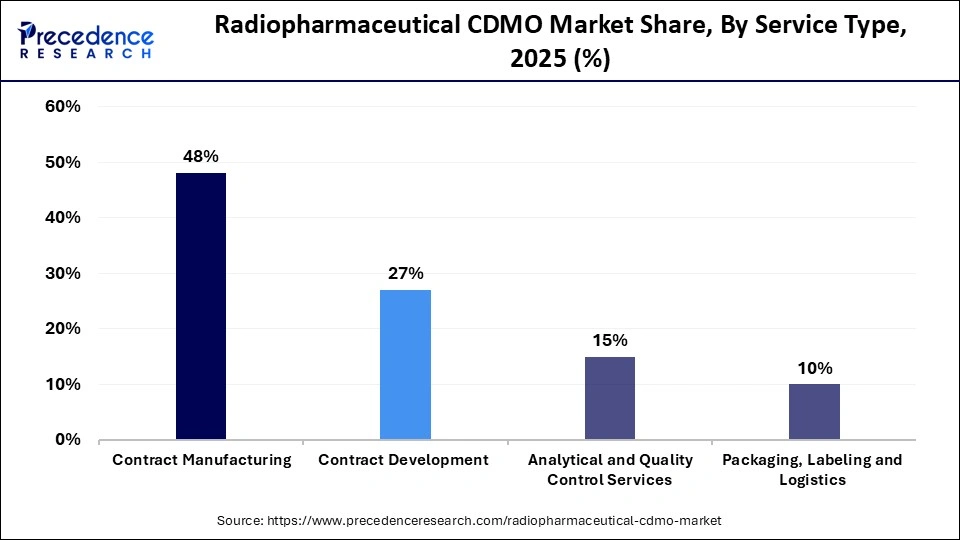

Service Type Leadership: Contract manufacturing led the market with approximately 48% share in 2025, reflecting growing outsourcing by pharmaceutical innovators. - Fastest-Growing Service: Packaging, labeling & logistics services are expected to expand at the highest CAGR from 2026 to 2035, supported by the need for secure and time-sensitive isotope handling.

- Therapeutic Area Leadership: Oncology dominated the market with a 71% share in 2025, driven by high demand for radiopharmaceutical cancer treatments.

-

Fastest-Growing Therapeutic Area: Neurology is anticipated to grow at the fastest CAGR from 2026 to 2035, supported by expanding applications in brain imaging and neurodegenerative disease diagnostics.

What is a Radiopharmaceutical CDMO?

Radiopharmaceutical CDMO is a specialized service provider that offers services like regulatory compliance, drug development, and clinical manufacturing. The various applications of radiopharmaceutical CDMO are diagnostic imaging, drug development, targeted cancer therapy, theranostics development, clinical trials, and commercial-scale manufacturing. It offers benefits like specialized expertise, quality assurance, advanced technology capabilities, accelerated drug development, supply chain security, and cost efficiency.

The contract development and manufacturing organization (CDMO) market is experiencing strong growth driven by rising outsourcing from biotech and pharmaceutical companies seeking cost efficiency, faster time-to-market, and specialized capabilities. The radiopharmaceutical CDMO market growth is driven by the high need for targeted cancer therapies, growing demand for complex manufacturing, robust growth in outsourcing, increased need for GMP-accredited facilities, increasing new drug candidates, and the transition towards tailored treatments.

➡️ Become a valued research partner with us ☎ https://www.precedenceresearch.com/schedule-meeting

Private Industry Investments for Radiopharmaceutical CDMO:

- Lantheus’ Acquisition of Evergreen Theragnostics (2025): Lantheus agreed to acquire Evergreen Theragnostics for up to $1 billion to secure advanced manufacturing infrastructure and reduce its reliance on third-party suppliers for clinical-stage radiopharmaceuticals.

- PharmaLogic’s Majority Stake in Agilera Pharma (2025): PharmaLogic acquired a majority stake in Norway-based Agilera Pharma to establish a globally integrated CDMO platform capable of scaling the production of therapeutic radiopharmaceuticals.

- SK Pharmteco’s Acquisition of Center for Breakthrough Medicines (2023): SK Pharmteco took a controlling interest in CBM to bolster its multi-modality capabilities, integrating specialized manufacturing for cell therapies and the high-demand radiopharmaceutical market.

- Nucleus RadioPharma’s Multi-State Expansion (2024): Nucleus RadioPharma secured significant backing to launch new facilities in Arizona and Pennsylvania, aiming to triple its capacity to meet the growing global demand for radioligand therapies.

-

EQT-backed Recipharm’s Strategic Realignment (2024): Private equity firm EQT directed Recipharm to divest legacy assets and reinvest specifically in high-growth sterile fill-finish capabilities essential for the complex production of radiopharmaceutical drug products.

Immediate Delivery Available | Buy This Premium Research Report@ https://www.precedenceresearch.com/checkout/7320

Radiopharmaceutical CDMO Market Trends

- Decentralized "Just-in-Time" Manufacturing Networks: The industry is moving away from massive centralized plants toward distributed networks of regional facilities located near major patient hubs. This shift is essential to overcome the "tyranny of the half-life," ensuring that short-lived isotopes can be manufactured and delivered to hospitals within the narrow window before they lose their efficacy.

- Vertical Integration of Isotope Supply: To mitigate chronic shortages of critical radionuclides like Lutetium-177 and Actinium-225, CDMOs are increasingly integrating isotope production directly into their manufacturing sites. By operating their own cyclotrons and securing long-term supply partnerships, these organizations aim to eliminate the supply chain bottlenecks that have historically delayed clinical trials and commercial launches.

Built for leaders who move markets. Access live, actionable intelligence with Precedence Q. https://www.precedenceresearch.com/precedenceq/

Radiopharmaceutical CDMO Market Opportunity

Growing Expansion of Targeted Therapies

The growing number of cancer patients and the strong focus on enhancing the quality of life increase demand for targeted therapies. The robust growth in theranostics and the proliferation of clinical trials increase demand for targeted therapies. The increased prevalence of solid tumors and the focus on lowering the side effects of medicine increase demand for targeted therapies, which require radiopharmaceutical CDMO.

The strong focus on molecular pathways and the rising diagnosis of lung cancers increases demand for radiopharmaceutical CDMO. The increased development of small drugs and the expansion of specialized centers require a radiopharmaceutical CDMO. The growing expansion of targeted therapies creates an opportunity for the growth of the radiopharmaceutical CDMO market.

Get informed with deep-dive intelligence on AI’s market impact https://www.precedenceresearch.com/ai-precedence

Radiopharmaceutical CDMO Market Insights

| Report Metrics | Details |

| Market Size in 2025 | USD 3.24 Billion |

| Market Size in 2026 | USD 3.57 Billion |

| Market Size by 2035 | USD 8.50 Billion |

| Market Growth (2026 – 2035) | 10.12% CAGR |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Application, Radioisotope Type, Service Type, Therapeutic Area, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

➤ Access the Full Radiopharmaceutical CDMO Market Study @ https://www.precedenceresearch.com/radiopharmaceutical-cdmo-market

Radiopharmaceutical CDMO Market Regional Insights

What is the Size of the North America Radiopharmaceutical CDMO Market in 2026?

According to Precedence Research, the North America radiopharmaceutical CDMO market size is valued at USD 1.75 billion in 2026 and is expected to reach approximately USD 4.21 billion by 2035, accelerating at a CAGR of 10.23% between 2026 and 2035.

Why North America is Dominating the Radiopharmaceutical CDMO Market?

North America dominated the market with a 49% share in 2025. The increased use of cardiac therapies and the well-established biotech companies increase demand for radiopharmaceutical CDMO. The growth in outsourced drug development and the growing use of PET imaging increase the adoption of radiopharmaceutical CDMO. The favorable reimbursement policies and the growing cancer incidence drive the overall market growth.

How Big is the Size of the U.S. Radiopharmaceutical CDMO Market in 2026?

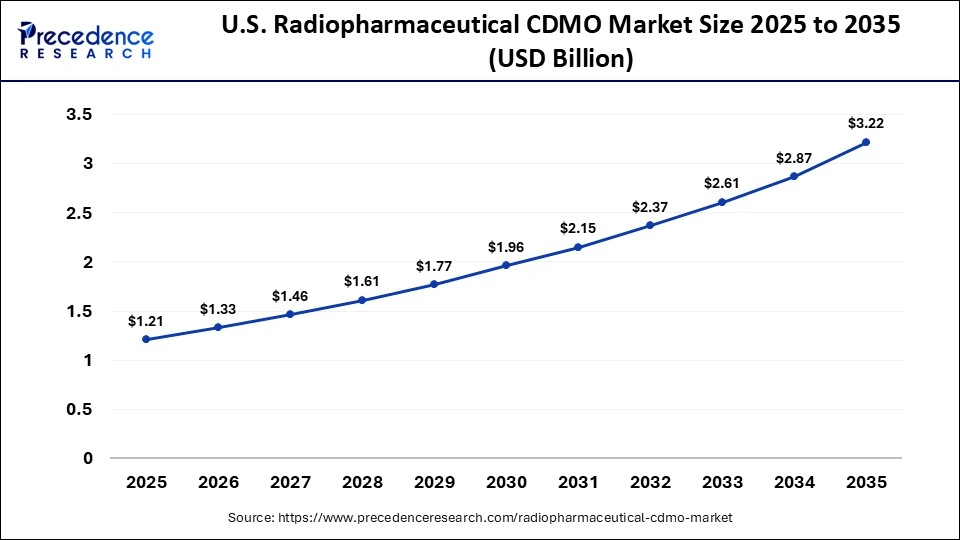

The U.S. radiopharmaceutical CDMO market size is predicted to cross around USD 3.22 billion in 2035, increasing from USD 1.33 billion in 2026, growing at a healthy CAGR of 10.28% from 2026 to 2035.

Note: This report is readily available for immediate delivery. We can review it with you in a meeting to ensure data reliability and quality for decision-making.

Try Before You Buy – Get the Sample Report@ https://www.precedenceresearch.com/sample/7320

U.S. Radiopharmaceutical CDMO Market Trends

The U.S. market is experiencing strong growth as pharmaceutical and biotech companies increasingly outsource development and GMP manufacturing of complex radioactive therapies, particularly in oncology and theranostics. Regulatory clarity and evolving FDA guidance are encouraging greater domestic investment, while the US maintains leadership due to its advanced nuclear medicine infrastructure and clinical research ecosystem.

Which Region is experiencing the Fastest Growth in the Radiopharmaceutical CDMO Market?

Asia Pacific is experiencing the fastest growth in the market during the forecast period. The growing cancer burden and rapid expansion of pharmaceutical manufacturing increase demand for radiopharmaceutical CDMO. The increasing use of targeted therapies and the growing manufacturing of radioactive isotopes increases the adoption of radiopharmaceutical CDMO. The surge in theranostics and the popularity of personalised medicine increases adoption of radiopharmaceutical CDMO, supporting the overall market growth.

China Radiopharmaceutical CDMO Market Trends

In China's market, rapid growth is being driven by expanding local production capacity and increasing investment in isotope manufacturing and clinical supply chains to meet a great and rising domestic demand for diagnostic and therapeutic radiopharmaceuticals. The broader CDMO sector in China is expanding substantially, with firms investing in advanced biologics and complex drug manufacturing capabilities and adopting digitalization and automated technologies to stay competitive globally.

You can place an order or ask any questions. Please feel free to contact us at sales@precedenceresearch.com | +1 804 441 9344

Radiopharmaceutical CDMO Market Segmental Insights

Application Insights

Which Application Dominated the Radiopharmaceutical CDMO Market?

The diagnostic radiopharmaceuticals segment dominated the market with approximately 62% share in 2025. The increased utilization of non-invasive imaging in hospitals and the growing focus on early detection of oncology diseases increase demand for diagnostic radiopharmaceuticals. The increased utilization of Tc-99m and the growing rate of chronic ailments increases adoption of diagnostic radiopharmaceuticals. The rising popularity of theranostics drives the overall growth of the market.

The therapeutic radiopharmaceuticals segment is the fastest-growing in the market during the forecast period. The growing utilization of targeted therapy and the expansion of novel radioisotopes increase demand for therapeutic radiopharmaceuticals. The stricter regulatory compliance and the development of personalised medicine increases adoption of therapeutic radiopharmaceuticals. The growing rate of cardiovascular diseases and the robust growth in clinical pipelines support the overall market growth.

Radioisotope Type Insights

How did the Flourine-18 Segment hold the Largest Revenue Share in the Radiopharmaceutical CDMO Market?

The Flourine-18 segment held the largest revenue share of around 34% in the industry in 2025. The increased use of flurodeoxyglucose and the rising popularity of CT systems increase demand for fluorine-18. The well-established pipeline of urology and the strong focus on approving new drugs increase demand for fluorine-18. The optimal physical properties and large production capacity drive the market growth.

The Actinium-225 segment is experiencing the fastest growth in the market during the forecast period. The increased development of promising drug candidates and the transition towards theranostics increase demand for actinium-225. The unmatched therapeutic efficacy, clinical success, and high value addition of actinium-225 support the overall market growth.

Service Type Insights

Why the Contract Manufacturing Segment is Dominating the Radiopharmaceutical CDMO Market?

The contract manufacturing segment dominated the industry with approximately 48% share in 2025. The increased utilization of novel radiopharmaceuticals and the focus on compliant production increase demand for contract manufacturing. The need for specialized delivery and investment in cyclotrons increases the adoption of contract manufacturing. The high entry barriers, cost efficiency, and regulatory expertise of contract manufacturing drive the market growth.

The packaging, labeling, and logistics segment is the fastest-growing in the market during the forecast period. The focus on protecting product integrity and the growing need for integrated services increase the adoption of packaging. The robust growth in radioligand therapies and the growing serialization help market expansion. The logistics specialization, growing outsourcing, and small batch flexibility support the overall market growth.

Therapeutic Area Insights

Which Therapeutic Area held the Largest Share in the Radiopharmaceutical CDMO Market?

The oncology segment held the largest revenue share of 71% in the industry in 2025. The growing burden of cancer and the robust growth in neuroendocrine tumors increase demand for radiopharmaceutical CDMO. The increased utilization of therapeutic solutions in cancer and the outsourcing trends help market expansion. The increased diagnosis of oncology and the high investment in cancer therapies drive the market growth.

The neurology segment is experiencing the fastest growth in the market during the forecast period. The growing prevalence of neurodegenerative disorders and the innovation in medical imaging increase demand for radiopharmaceutical CDMO. The increased diagnosis of dementia and the complexity of neuro-radiopharmaceuticals increases adoption of radiopharmaceutical CDMO. The heavy investment in neurology-focused radiopharmaceuticals supports the overall market growth.

✚ Related Topics You May Find Useful:

➡️ Global Pharmaceutical CDMO Market: Explore how outsourcing partnerships are reshaping drug development, scaling production, and accelerating time-to-market

➡️ Pharmaceutical CDMO for Formulations Market: Discover innovation in advanced drug formulations and the growing demand for specialized development expertise

➡️ U.S. Pharmaceutical CDMO Market: Understand how domestic manufacturing expansion and regulatory focus are strengthening America’s pharma supply chain

➡️ Pharmaceutical Manufacturing Market: Track modernization trends in large-scale drug production, automation, and global capacity investments

➡️ Investigational New Drug CDMO Market: See how early-stage development support is enabling faster clinical pipelines and biotech innovation

➡️ Biologics CDMO Market: Analyze the surge in biologic therapies and the need for complex, high-value manufacturing capabilities

➡️ Europe Pharmaceutical CDMO Market: Gain insight into regional investment, regulatory alignment, and cross-border pharma collaborations

➡️ Sterile Injectables CDMO Market: Discover rising demand for precision manufacturing in high-growth injectable therapeutics

➡️ mRNA Therapeutics CDMO Market: Track expansion driven by next-generation vaccine platforms and genetic medicine breakthroughs

➡️ Peptide Therapeutics CDMO Market: Understand how peptide-based drugs are creating new opportunities for specialized production services

➡️ Cell and Gene Therapy CDMO Market: Explore infrastructure growth supporting advanced therapies and personalized medicine

➡️ Pharmaceutical Contract Manufacturing and Research Services Market: See how integrated service models are streamlining R&D and commercial manufacturing

➡️ Contract Research Organization Market: Examine the role of CROs in accelerating clinical trials and global drug approvals

➡️ Topical Drugs CDMO Market: Discover growth in dermatology and transdermal therapies requiring niche formulation expertise

➡️ Rare Disease Small Batch CDMO Market: Understand how precision manufacturing is enabling orphan drug development

➡️ Personal Care CMO and CDMO Market: Track outsourcing trends in cosmetics and personal care driven by brand innovation and speed-to-market

Top Companies in the Radiopharmaceutical CDMO Market & Their Offerings:

Tier 1:

- Curium Pharma: Provides global manufacturing and distribution for third-party tracers via its massive PET and SPECT network.

- Eckert & Ziegler: Specializes in process design and scale-up for therapies labeled with alpha-emitting isotopes like Actinium-225.

- ITM Isotope Technologies Munich: Acts as a manufacturing partner by supplying high-quality medical isotopes and specialized radiolabeling equipment.

- NorthStar Medical Radioisotopes: Offers CDMO services utilizing accelerator-based technology for production of isotopes like Ac-225 and Cu-67.

- Cardinal Health: Delivers end-to-end solutions from early-phase clinical development to commercial distribution via its nuclear pharmacy network.

- SOFIE Biosciences: Operates a manufacturing center of excellence for diagnostic and therapeutic compounds from R&D through commercialization.

-

PharmaLogic Holdings: Specializes in the clinical and commercial production of radiopharmaceuticals through a robust network of over 45 facilities.

Tier 2:

- SpectronRx

- Monrol

- SHINE Technologies

- IONETIX Corporation

- Nucleus RadioPharma

- Evergreen Theragnostics

- Minerva Imaging

- Seibersdorf Labor GmbH

- Nihon Medi-Physics

Recent Developments

- In January 2026, IRE selected Lemer Pax to equip its new radiopharmaceutical CDMO facility in Fleurus. It offers a fully-GMP-compliant environment and maintains stringent safety. The facility manufactures radiopharmaceutical products and offers various radionuclides. (Source:-https://www.lemerpax.com)

- In October 2024, NorthStar Medical Radioisotopes launched a radiopharmaceutical CDMO facility. The facility develops medical radioisotopes like Lu-177, Cu-67, Ac-225, In-111, and Cu-64. The facility focuses on providing access to radiopharmaceuticals and manufacturing novel radiopharmaceuticals.

(Source:-https://www.northstarnm.com)

Segments Covered in the Report

By Application

- Diagnostic Radiopharmaceuticals

- Therapeutic Radiopharmaceuticals

By Radioisotope Type

- Fluorine-18

- Technetium-99m

- Gallium-68

- Lutetium-177

- Actinium-225

- Others

By Service Type

- Contract Manufacturing

- Contract Development

- Analytical & Quality Control Services

- Packaging, Labeling & Logistics

By Therapeutic Area

- Oncology

- Neurology (Fastest Growing)

- Cardiology

- Others (Nephrology, Inflammation, Rare Diseases)

By Region

-

North America

- U.S.

- Canada

- Mexico

- Rest of North America

-

South America

- Brazil

- Argentina

- Rest of South America

-

Europe

-

Western Europe

- Germany

- Italy

- France

- Netherlands

- Spain

- Portugal

- Belgium

- Ireland

- UK

- Iceland

- Switzerland

- Poland

- Rest of Western Europe

-

Eastern Europe

- Austria

- Russia & Belarus

- Türkiye

- Albania

- Rest of Eastern Europe

-

Western Europe

-

Asia Pacific

- China

- Taiwan

- India

- Japan

- Australia and New Zealand,

- ASEAN Countries (Singapore, Malaysia)

- South Korea

- Rest of APAC

-

MEA

- GCC Countries

- Saudi Arabia

- United Arab Emirates (UAE)

- Qatar

- Kuwait

- Oman

- Bahrain

- South Africa

- Egypt

- Rest of MEA

- GCC Countries

Thank you for reading. You can also get individual chapter-wise sections or region-wise report versions, such as North America, Europe, or Asia Pacific.

Immediate Delivery Available | Buy This Premium Research Report@ https://www.precedenceresearch.com/checkout/7320

You can place an order or ask any questions. Please feel free to contact us at sales@precedenceresearch.com | +1 804 441 9344

Stay Ahead with Precedence Research Subscriptions

Unlock exclusive access to powerful market intelligence, real-time data, and forward-looking insights, tailored to your business. From trend tracking to competitive analysis, our subscription plans keep you informed, agile, and ahead of the curve.

Browse Our Subscription Plans@ https://www.precedenceresearch.com/get-a-subscription

About Us

Precedence Research is a worldwide market research and consulting organization. We give an unmatched nature of offering to our customers present all around the globe across industry verticals. Precedence Research has expertise in giving deep-dive market insight along with market intelligence to our customers spread crosswise over various undertakings. We are obliged to serve our different client base present over the enterprises of medicinal services, healthcare, innovation, next-gen technologies, semi-conductors, chemicals, automotive, and aerospace & defense, among different ventures present globally.

Web: https://www.precedenceresearch.com

Our Trusted Data Partners:

Towards Healthcare | Towards Packaging | Towards Chem and Materials | Towards FnB | Statifacts | Nova One Advisor | Market Stats Insight

Get Recent News:

https://www.precedenceresearch.com/news

For the Latest Update Follow Us:

LinkedIn | Medium | Facebook | Twitter

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.